CMS cost analysis fuels controversy over rise of limited pharmacy networks

Results of a recent federal survey of Medicare Part D claims is again roiling the sometimes strained relationship between independent and smaller-chain community pharmacies and managed care, and could herald a growing threat to those pharmacies as health plan payers and pharmacy benefit managers abandon open pharmacy provider networks and shift more business to exclusive preferred pharmacy groups.

The new survey comes from the Centers for Medicare and Medicaid Services. Based on a study of Medicare prescription claims received in March 2012 by 13 Part D prescription drug plans, CMS reported that a majority of those prescriptions cost an average of about 6% less for PDPs when generated by a pharmacy in a preferred pharmacy network, compared with the costs of a prescription filled in a non-preferred pharmacy in an open-provider network.

"At the contract level, excluding mail order, we find that aggregate unit costs weighted by utilization [meaning costs per dose] were lower in preferred networks for the majority of sponsors with this type of network," CMS reported.

Nevertheless, the government's findings aren't a slam-dunk for the PBM industry. In reporting its survey conclusions, CMS takes a more nuanced view.

"Based on a one-month sample, negotiated pricing for the top 25 brands and 25 generics in the Part D program at preferred retail pharmacies is lower than at non-preferred network pharmacies," the agency noted. "However, there are different results between sponsors once we include mail-order pharmacy costs. When both mail and retail pharmacy costs are included, some sponsors' preferred network pharmacies are offering somewhat higher negotiated prices than are offered by their non-preferred network pharmacies. Thus, our hypothesis that preferred network pharmacy negotiated prices are lower than non-preferred network ... was not confirmed."

Indeed, CMS concluded, "negotiated prices are sometimes higher in certain preferred networks — contrary to our expectations."

Responding to the report, the National Community Pharmacists Association took note of CMS' finding that some preferred networks generate higher costs, and warned that "preferred pharmacy plans ... are not in the best interests of many patients" and "amount to government-sanctioned bias against small business." But the pharmacy benefit management industry, which supports limited pharmacy provider networks for employer-sponsored health plans and Part D PDPs, was quick to seize on the survey findings.

"The CMS analysis confirms that negotiated prices at preferred pharmacies are lower on average than at non-preferred pharmacies," said Mark Merritt, president and CEO of the Pharmaceutical Care Management Association. "Indeed, government and beneficiary savings from preferred pharmacy network plans are likely even greater, as the government's analysis takes into account only part of the savings from these plans."

Merritt said additional savings come from "other factors, including premiums, reinsurance and post point-of-sale price concessions, that ultimately determine CMS payments to preferred network plans."

PCMA has long advocated preferred pharmacy networks as a cost-saving tool for public and private pharmacy benefit plan sponsors. "The tools utilized by Medicare Part D plans — including preferred pharmacy networks and generic alternatives — are delivering savings," the PBM advocacy group asserted. "While preferred physician and hospital networks have long been used to reduce costs, there is a growing understanding of the cost-savings potential of pharmacy networks."

To argue its case that limited pharmacy networks that exclude thousands of independent and small-chain operators would still provide plenty of access for seniors everywhere, PCMA also makes a stunning declaration, essentially equating community pharmacies with fast-food joints. "Today, there are more drug stores in the United States than McDonald's, Burger Kings, Pizza Huts, Wendy's, Taco Bells, Kentucky Fried Chickens, Domino's Pizzas and Dunkin' Donuts combined, creating a highly competitive environment," the group noted.

Citing a study from health consulting firm Visante, PCMA also predicts that "greater use of preferred and limited pharmacy networks could save Medicare an additional $35 billion over the next ten years while meeting the program's pharmacy access standards."

For both chain and independent pharmacy retailers, the growth of preferred pharmacy networks and exclusive-provider contracts between pharmacies and PDPs carries explosive disruptive potential. Medicare Part D accounts for roughly 1-of-5 U.S. prescriptions dispensed at retail, according to CMS. And both public and employer-funded health plan sponsors and the plans themselves — not to mention the patients enrolled in those plans — are shifting in greater numbers to those limited pharmacy networks to capture perceived savings.

Many patients seem willing to accept the inconvenience that comes with having a substantially reduced network of pharmacies from which to choose to obtain their prescriptions via whatever Part D PDP they're covered by. Savings, in many cases, are trumping choice and convenience.

"Given the 2013 growth in these networks," Pembroke Consulting president Adam Fein reported recently, "I expect CMS to update its guidelines regarding preferred networks. However, the cost savings shown in this [CMS] report support my view that preferred networks will continue to grow."

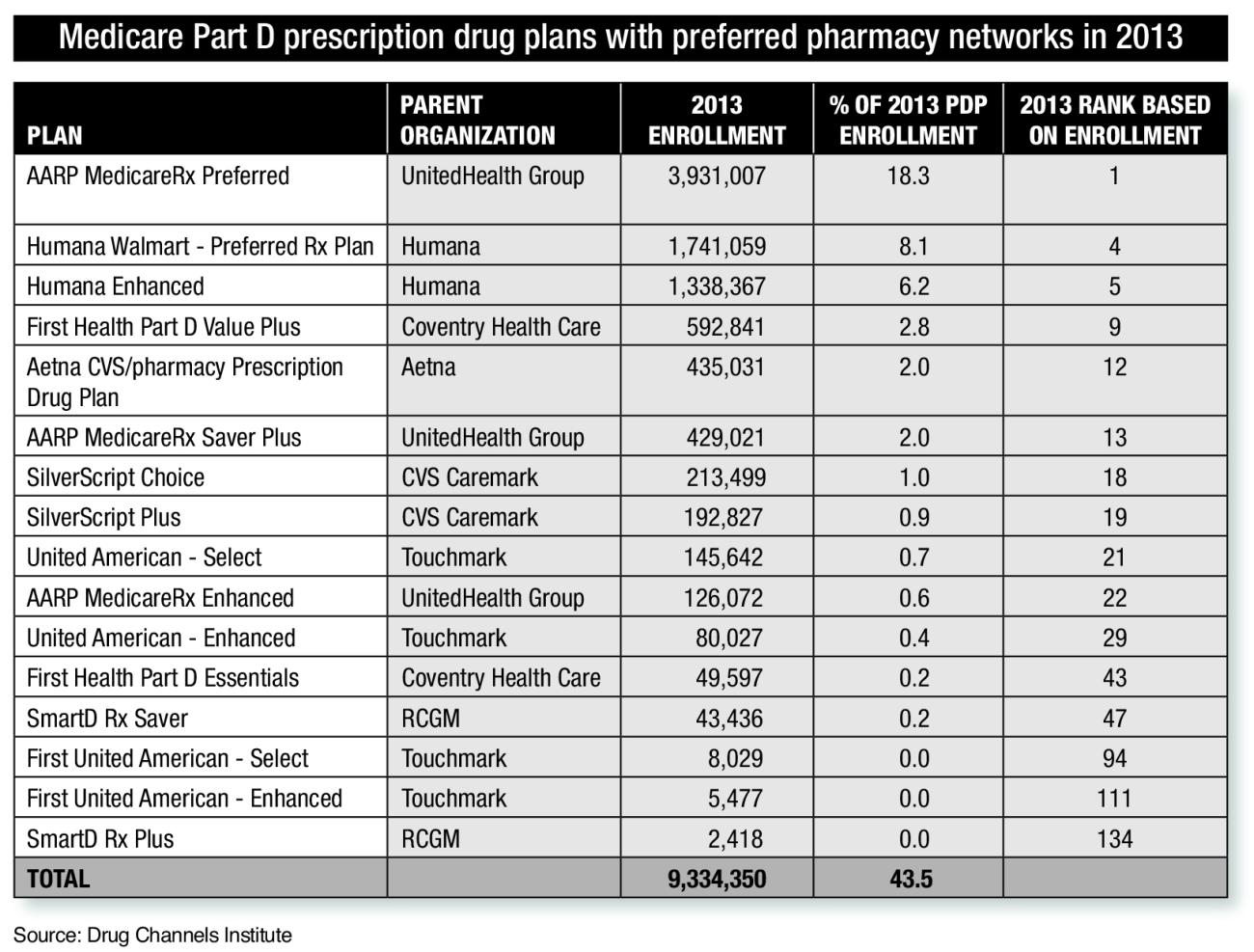

As Fein noted earlier this year, only "16 of 2013's 190 PDPs have a preferred pharmacy network design." However, that list of 16 preferred network plans includes most of the nation's biggest and most influential PDPs. Those plans determine the size and scope of the pharmacy provider network for the largest number of Medicare Part D beneficiaries and wield the power to determine the market, essentially, for a substantial portion of the U.S. prescription dollar for the more than 22.6 million seniors enrolled in a PDP in 2013.

According to an analysis of CMS data from Pembroke, "more than 4-out-of-10 seniors [are] enrolled in one of these 16 plans" this year, and "seniors are increasingly choosing preferred networks."

"In 2013, narrower pharmacy network models will become a mainstream staple of both commercial and Medicare Part D plans," Fein predicted. "Expect these networks' success to prompt howls of protest from the non-participating pharmacies."