GM hierarchy creates common language

Global Market Development Center and Nielsen last year released a platform to organize and quantify general merchandise category data in order to increase marketplace performance and provide better understanding of the general merchandise categories.

“It’s really no secret that something really important has been missing in the GM industry for quite a long time now,” Mike Winterbottom, GMDC VP information technology/CTO, told viewers of what is now an archived presentation introducing the GMDC/Nielsen GM Hierarchy on GMDC*Connect. “And that missing component has been a common framework, a common reference point.”

“A hierarchy is great because it does create that common language; it does create that common view into the conversation about general merchandise,” Stuart Taylor, Nielsen SVP custom analytics, reported on the GMDC*Connect archived presentation. “But it’s really just a starting point. What are you going to use it for?”

What the GM Hierarchy does is establish the size and share of GM and its categories and sub-categories across channels. Which categories are growing? Which are declining? What is GM’s share of store distribution by category? What are the characteristics of retailers who are growing with GM?

What the GM Hierarchy does is establish the size and share of GM and its categories and sub-categories across channels. Which categories are growing? Which are declining? What is GM’s share of store distribution by category? What are the characteristics of retailers who are growing with GM?

“The leaders appear to be finding growth trends within general merchandise and capitalizing on those sooner than the laggards,” Taylor said. “It seems like such a simple concept, but it makes such a big difference in market, in terms of not just driving general merchandise sales, but frankly, driving total store sales.”

One of the challenges seen in GM is a decline in share of shelf in grocery, despite the fact that the channel is growing in GM dollar sales, GMDC noted in a whitepaper that was released in January outlining the GM Hierarchy. Prior research from Nielsen has shown the importance of driving store traffic across the total store — if focus is only spent on the perimeter, then center store begins to shrink.

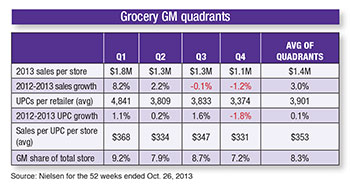

To measure the success of GM within grocery, GMDC and Nielsen divided the retail channel into four quadrants based on dollar sales per store that fundamentally categorized the level of success. Ninety reportable grocer retailers were included in the analysis, as they represent about 75% of the grocery channel, GMDC noted, excluding most independents and making the analysis generally chain-driven.

What GMDC and Nielsen found is that the top quadrant of supermarket retailers is growing four times as fast in GM as that of the next quadrant because they are driving growth in shopper-relevant GM categories, making them a viable choice for trips against competition. Qualities that further define the top quadrant are that they drive growth across both large and small GM categories, they invest in high-growth categories and they command a price premium while maintaining and growing unit turns.

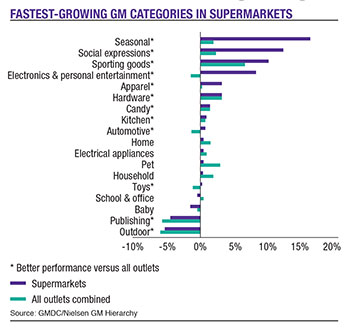

Nielsen coded more than 20 million UPCs in an effort to define the common platform that makes up the GM Hierarchy. According to the research, the GM industry has $206 billion in all-outlet sales, with a growth rate of 0.4%. The GMDC/Nielsen GM Hierarchy confirmed that the top five best-selling GM categories in grocery are pet, candy, baby, household and social expressions. According to the whitepaper, seasonal, social expressions, sporting goods, electronics and apparel are the top five fastest-growing GM categories in supermarkets.

Nielsen coded more than 20 million UPCs in an effort to define the common platform that makes up the GM Hierarchy. According to the research, the GM industry has $206 billion in all-outlet sales, with a growth rate of 0.4%. The GMDC/Nielsen GM Hierarchy confirmed that the top five best-selling GM categories in grocery are pet, candy, baby, household and social expressions. According to the whitepaper, seasonal, social expressions, sporting goods, electronics and apparel are the top five fastest-growing GM categories in supermarkets.

“Having the ability to compare our retailers’ GM performance on a category-by-category basis against the marketplace will help us to analyze where there are issues,” said Bob Zekis, EVP business development of Imperial Distributors, in the whitepaper. “Poor performance might indicate assortment issues, promotional issues, merchandising issues or opportunities with space allocation. There may be operational issues within the stores, or even organization issues. Now that the data says this is what’s working and this is what’s not, we want to ensure that we capitalize on what is working and take remedial action against what isn’t.”