Pfizer exploring OTC divestiture? RB, Sanofi most likely suitors

NEW YORK - Pfizer CEO and chairman Ian Read may have hinted earlier this month at the company's interest in divesting its consumer health unit, which recent reports value at $14 billion.

"The consumer business [is] a valuable business," Read told analysts during the company's discussion on its third quarter results. "It's growing well. We're investing. We've made acquisitions. But like all our businesses, we all look at them and we subject them to tests of are they worth more inside or outside of Pfizer?" he said. "And we'll continue to run those tests."

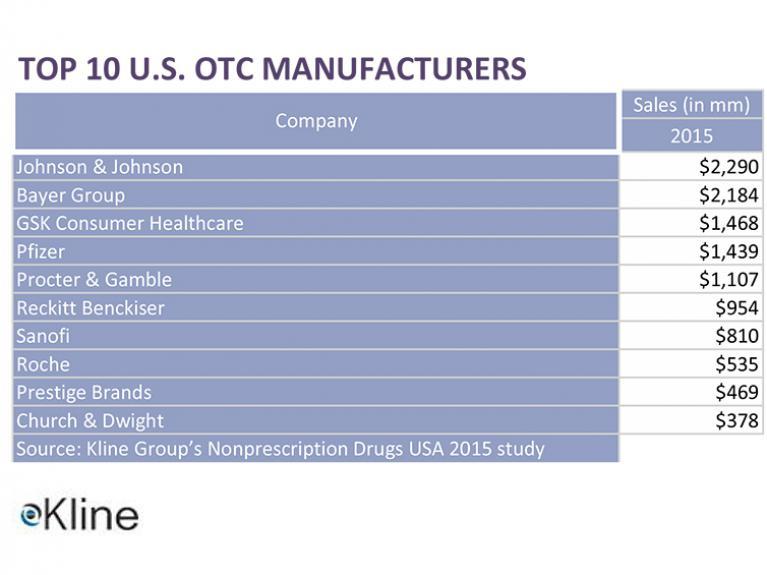

According to Kline Group, Pfizer's consumer business boasts annual sales of about $1.4 billion in manufacturer-level sales and ranks No. 4 behind Johnson & Johnson/McNeil, Bayer (which recently acquired Merck's consumer business) and GSK Consumer Healthcare (which recently entered into a joint venture with Novartis on its collective consumer businesses).

Reuters on Wednesday confirmed that Pfizer is in fact exploring the possibility of a divestiture of its OTC business. That exploration is still in its early stages, cautioned Reuters' sources, and the company could determine that keeping the OTC business may be in the best interest of the company.

But should they decide to sell, the most likely suitor to a Pfizer acquisition would be Reckitt Benckiser, suggested Laura Mahecha, Kline Group Healthcare Industry Manager.

A combined RB-Pfizer entity would leapfrog J&J to become the top OTC player in Kline Group's ranking of OTC manufacturers, as measured by manufacturer-level sales. "That makes the most sense in terms of what RB would need to be a top player in the OTC world." Reckitt has in the past expressed interest in large OTC acquisitions, and has pulled the trigger on some of those acquisition targets, including the Schiff business, Mahecha said.

And the respective portfolios would appear to match well, Mahecha added, gaining RB significant entry into OTC pain and digestives. Pfizer's Advil is the No. 1 pain reliever in the U.S., with sales of $449.6 million for the 52 weeks ended Oct. 2, according to IRI across total U.S. multi-outlet channels.

Pfizer's antacid brand Nexium 24HR also holds the top spot in that category with sales of $311.3 million, up 6.4%, in that period. Pfizer's Centrum multivitamin brand is second in multivitamin sales only to Bayer's One-A-Day franchise, but that brand commands a sales volume of $286.5 million on 3.3% growth.

However, RB's penetration into the upper respiratory business with Mucinex and Delsym may be seen as a hurdle in acquiring Pfizer's Robitussin and Dimetapp cough/cold lineups. And RB boasts a healthy multivitamin brand in Airborne, which generated $126.7 million on 1.5% growth for the 52 weeks ended Oct. 2.

Sanofi, No. 7 on Kline Group's list of top U.S. OTC manufacturers, would be another possible suitor that comes to mind, Mahecha said.