The real retail health ecosystem

What is the state of the retail health ecosystem? More importantly, what does it look like? Drug Store News set out to answer both questions.

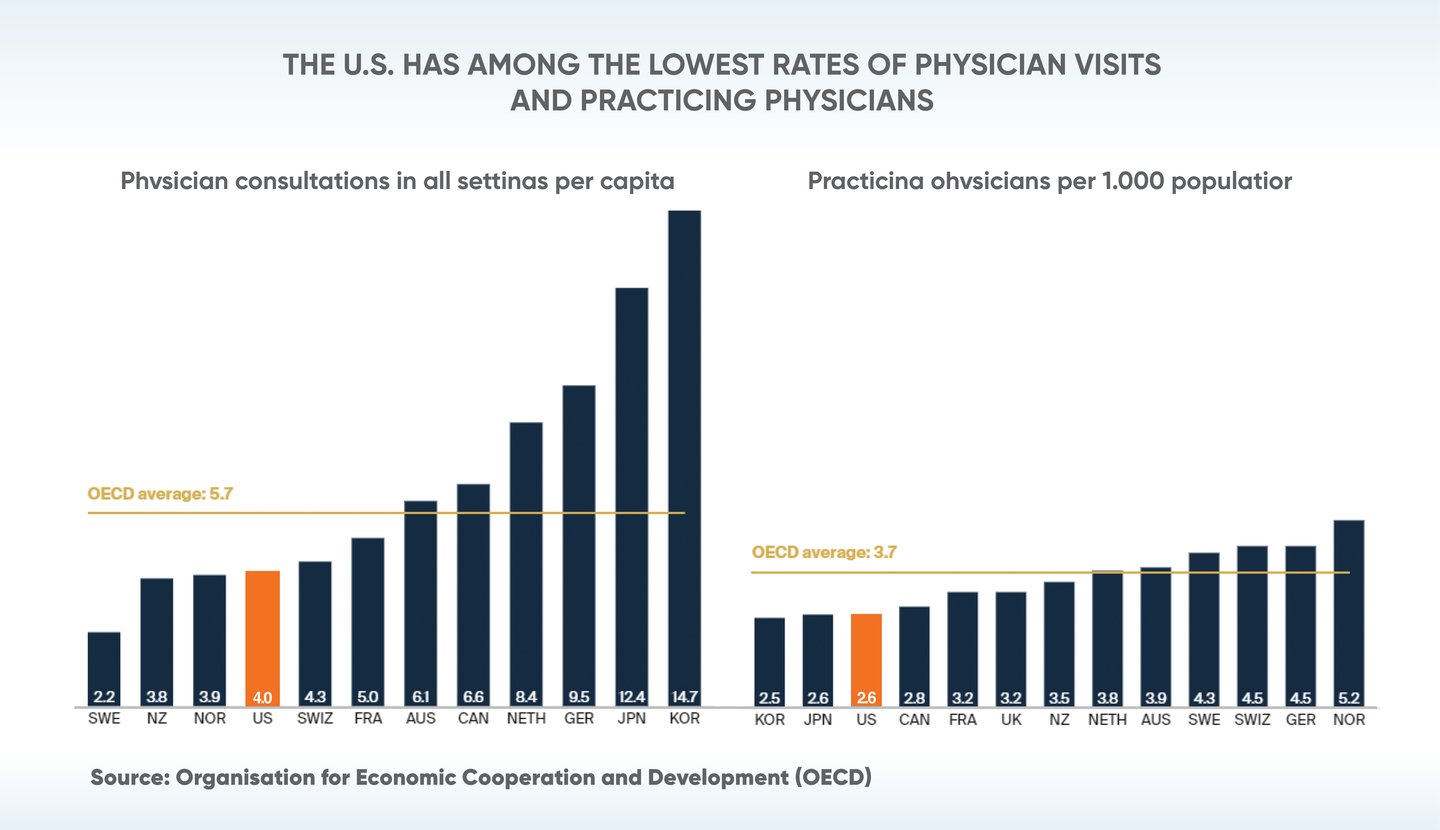

Retail pharmacy is having its moment. Over the years, the industry’s players have rightfully earned a reputation as patient navigators, serving as the first point of contact for patients and guiding them to the appropriate level of care. The COVID-19 pandemic accelerated this march toward recognition as a vital cog in the U.S. healthcare system.

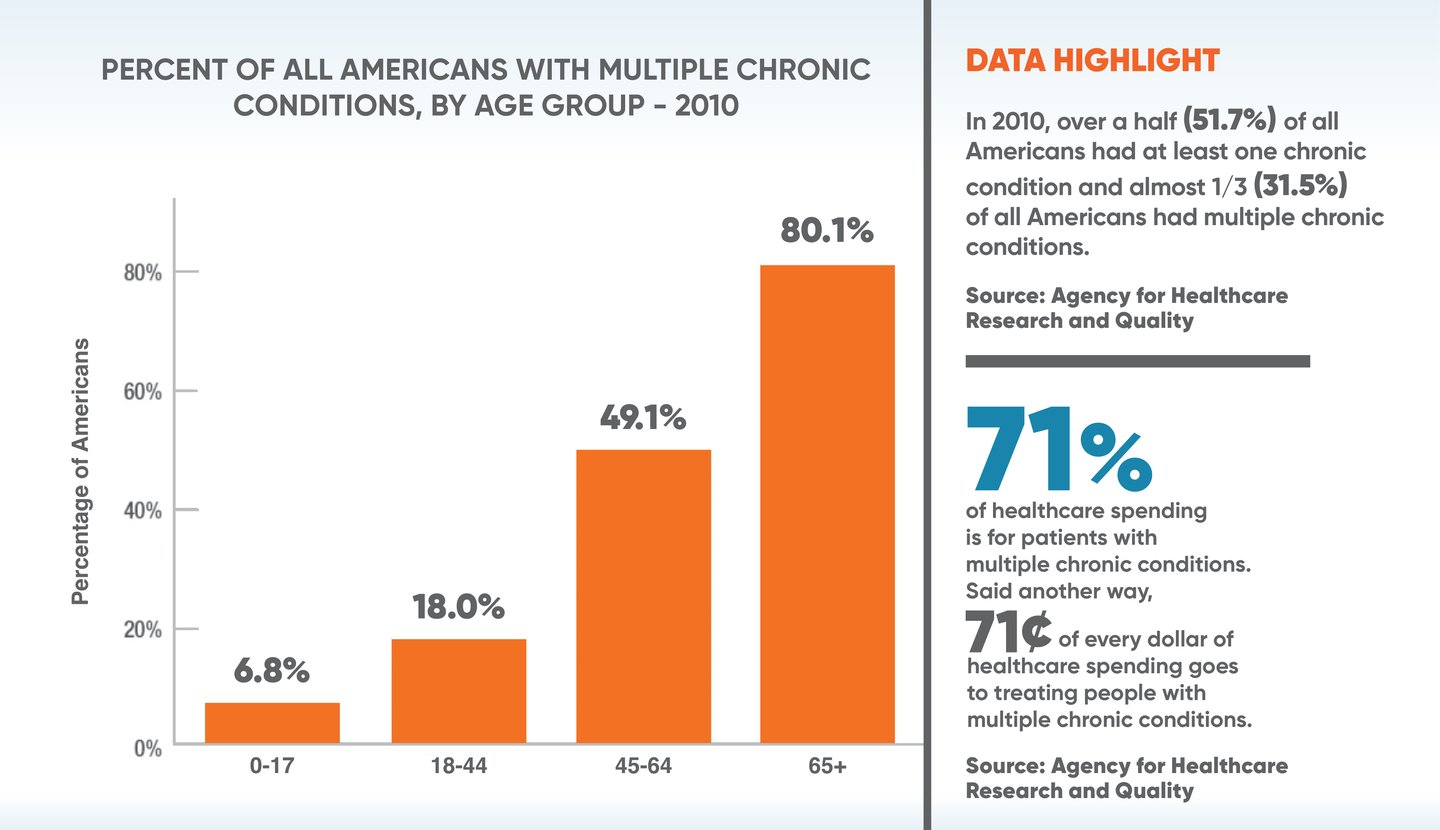

In addition to its swift actions amid the pandemic, retail pharmacy tallied numerous achievements, including helping patients and payers with disease prevention and management of chronic conditions and playing a significant role in eliminating costs associated with ER and hospital admissions, length of stays and readmissions.

The tailwinds and the factors in retail pharmacies’ favor are numerous. They include the increased demand for prescription drugs, an increased occurrence of chronic diseases and an aging population. Additionally, new and more innovative drugs are being approved by the FDA, and healthcare insurance has expanded.

Retail pharmacies’ strategy continues to be locating physical retail stores in high-traffic areas, with 90% of Americans residing within a 5-mile radius. Additionally, many pharmacy retailers have shifted their focus from expanding their footprint to improving store utilization and focusing on core pharmacy and health offerings, including participating in the nationwide “test to treat” initiative and prescribing medications in states where it is permitted.

To be sure, retail pharmacy is not only convenient, accessible, affordable and increasingly personalized, but it has also ratcheted up its technology to allow customers to order prescription drugs from their smartphones and computers and have the medications delivered to their homes or available for pick-up. Many pharmacies also have rolled out telehealth consultations, medication reminders and adherence monitoring capabilities.

Then there’s the integration of retail pharmacy with healthcare clinic services, poised to attract more customers and increase customer loyalty and retention by offering convenient and accessible care.

On the insurance front, pharmacies also are making headway. With lucrative Medicare Advantage plans and value-based care agreements outweighing the old model of “fee for service,” there are opportunities for providers, such as CVS and United Healthcare Optum, that are buying physician practices in states that contain a large number of Medicare Advantage members.

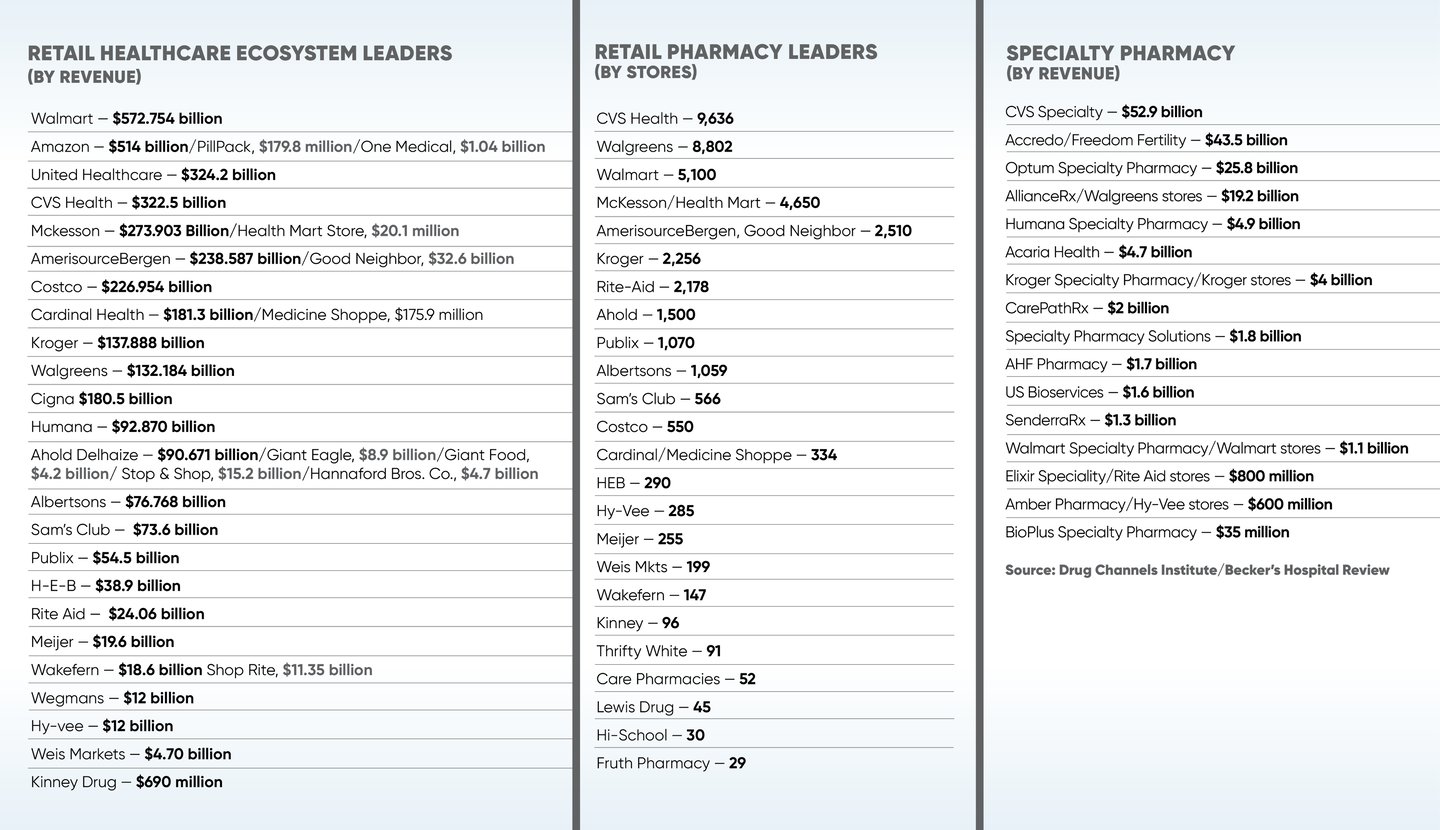

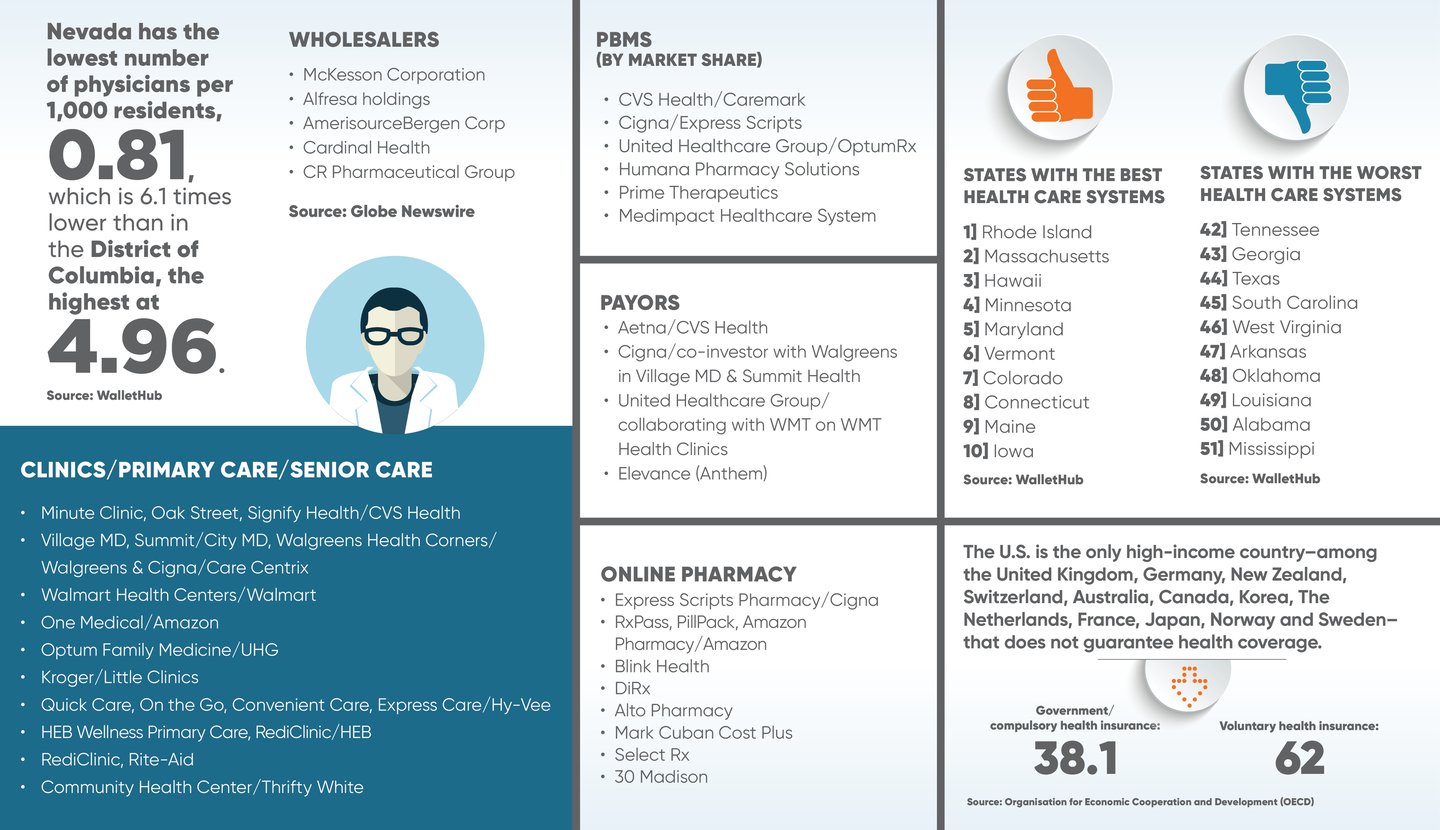

But, naturally, retail pharmacy does not exist in a vacuum; it’s part of a much bigger “ecosystem” that needs every entity to do its part. After months of legwork, Drug Store News this month is publishing The Real Retail Health Ecosystem report, listing all of the pieces that make up the retail healthcare ecosystem today, including regional pharmacies, insurance companies, virtual care companies, clinical services, wholesalers, insurance companies, home health care outlets and more. —Sandy Levy, Senior Editor

Online Pharmacies See Growing Sales

E-commerce prescription drug platforms, which gained momentum during the pandemic, have continued to increase their share of the pharmacy market by offering a combination of convenience and sharp pricing for consumers.

Revenues for this sector in the U.S. are projected to total $5.56 billion in 2023. They are expected to expand at a compound annual growth rate (CAGR) of 10.98% during the next five years, reaching $8.58 billion in 2027, according to data from Statista. The research also projects that user penetration will reach 36.85% by 2027, up from an estimated 32.71% in 2023.

Statista data also shows, however, that the top five traditional retail pharmacy operators—CVS, Walgreens, Walmart, Kroger and Rite Aid—account for more than 50% of the pharmacy market in the U.S., while pharmacy benefit managers’ mail order platforms account for the overwhelming majority of the remaining share.

Industry observers have long speculated that e-commerce giant Amazon could eventually have a significant impact on the traditional drugstore market, however. The company acquired online pharmacy PillPack in 2018, then launched the Amazon Pharmacy platform in 2020 and the RxPass discount program for Prime members this year. Other online players include Mark Cuban Cost Plus Drugs, Alto, Capsule, Hims & Hers Health, Nurx and others.

“CVS and Walgreens are ripe for disruption,” one industry analyst was quoted as saying when Amazon launched Amazon Pharmacy during the peak of the COVID-19 pandemic. Legacy brick-and-mortar retailers have not been ignoring the threat that e-commerce competitors could pose, however. They have expanded their digital capabilities to provide more personalized relationships with their customers and more convenient, omnichannel access to their services.

Meanwhile, many of the online pharmacies are highly specialized and lack the long-term

relationships that traditional drug retailers enjoy. Hims & Hers Health, for example, focuses primarily on the particular health concerns of men and women, while Mark Cuban’s Drug Cost Plus focuses on a limited list of generic medications that it can obtain at low cost.

Both those companies, along with others in the space, anticipate ongoing growth, however.

“We find ourselves at an inflection point in which reaping the benefits of our size and scale,” said Andrew Dudum, CEO of Hims & Hers Health, in a recent conference call with analysts during which the company reported

$527 million in revenues in 2022. “We believe our brand awareness and customer loyalty have never been stronger. Our product offerings have never been more expansive and personalized, and our platform scale and insights are enabling clinical excellence and efficiency unlike anything in the market today.” —Mark Hamstra

Hospital Partnerships Offer Potential ‘ Win-Win-Win’ Scenarios

Collaboration between retail pharmacies and hospitals presents big opportunities for both parties, as well as the promise of improved patient care.

Retail pharmacies offer the convenience of community-based touchpoints for patients, and are well-positioned to monitor patients’ medication adherence as well as their potential needs for other clinical and testing services.

Jeremy Faulks, VP of pharmacy operations at Plymouth, Minn.-based Thrifty White Pharmacy, which operates a chain of 100 retail pharmacies in the Upper Midwest, said his company sees a lot of potential for collaboration between retail pharmacies and healthcare networks and hospitals.

“We work very closely with a number of them, both in extending their ability to care for patients and offering expanded access for patients,” he said of the chain’s relationships with local hospitals and clinics.

For example, at one location Thrifty White offers a space where patients can have a telehealth meeting with a mental health professional at a clinic that is located a few towns away. The chain also offers medication administration, primarily for patients requiring long-term injectable therapies that would otherwise require scheduling appointments with doctors. “They can simply come to Thrifty White, and we can deliver that injection in our clinical suite,” said Faulks.

Thrifty White is also exploring opportunities to identify clinical needs, such as testing and screenings, among its patients in collaboration with local healthcare systems. These patients often visit pharmacies more frequently than their doctors, he explained, creating opportunities for deeper involvement in patient care.

In addition, Thrifty White has also opened two retail pharmacies that are physically located inside hospitals, with a third set to open this spring. In those locations, the retailer has been working closely with the on-site clinicians to collaborate on what clinical services the pharmacies can administer, such as vaccinations and potentially other services, such as risk assessments, “where the pharmacist can play a role and take some of that burden off the health system,” said Faulks.

Meanwhile, Vivo Health Pharmacy, a 10-unit retail banner operated by New Hyde Park, N.Y.-based Northwell Health, has an even deeper relationship with its parent company. The retailer has ready access to patient information, facilitating a more holistic level of care, said Onisis Stefas, CEO at Vivo Health.

“We honestly see our retail pharmacies as an extension of the healthcare system,” he said.

Vivo Health pharmacies are particularly focused on medication adherence. In fact, the company is exploring creating a system in which Northwell clinicians could be notified in real-time when a patient fails to pick up a scheduled prescription, allowing for potential interventions that could benefit the patient health and help provide a higher level of care.

Like Thrifty White, Vivo Health is also looking at opportunities to assist in steering patients toward appropriate diagnostic tests and other clinical services based on the frequency of interactions they have with those patients. Vivo can easily communicate directly with Northwell Health doctors to help them monitor patients, Stefas explained.

“We are really trying to leverage pharmacists as kind of patient navigators, educators, communicators ... to help support overall health and wellness,” he said. —Mark Hamstra