Analysts: Savings outweigh costs of specialty meds

No area of pharmacy is growing faster than specialty drugs.

(To view the full Chain Pharmacy Category Review, click here.)

“The specialty drug market has experienced tremendous growth in recent years as new high-cost specialty drugs, once limited to small patient populations, are increasingly indicated for more common chronic conditions that affect millions of Americans,” said Alan Lotvin, EVP of specialty pharmacy for CVS/caremark.

According to IMS Health, specialty medications, which five years ago made up slightly less than a quarter of spending on pharmaceuticals, accounted for a third of all drug spending in 2014 — and growth is unlikely to abate any time soon.

A report released last month by the market forecasting firm Research and Markets predicted that the growth of specialty drugs will not be limited to just the United States. The company said that worldwide the market for specialty pharmaceuticals will continue to grow by about 18% a year through 2020.

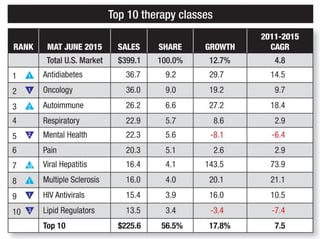

Much of that growth of specialty drugs will be driven by the proliferation of new drugs and the rapidly increasing number of patients relying on specialty medications. IMS data showed that over the 12 months through June, spending on new drugs — most of them considered specialty medications — accounted for $19.8 billion of the $45 billion in total pharmaceutical spending. Medications targeting viral hepatitis accounted for $11.3 billion of that total.

Other therapeutic areas are expected to account for much of the future increases.

“Oncology drugs have been filling the pipeline and will be the largest category of specialty drug approvals in the near future,” John Malley, leader of Aon Health’s Innovation Pharmacy Team, said in late August. “Specialty drugs for cholesterol may also have a significant impact, given that the market has not had this type of drug for such a prevalent disease state before.”

While specialty drug prices are a primary factor behind what some have suggested is out- of-control pharmaceutical price inflation, many healthcare analysts and economists contend that these medications can actually drive down the country’s total healthcare bill.

For instance, the $94,500 cost of the course of treatment to cure hepatitis C, with Gilead Sciences’ Harvoni, is far less than the nearly $600,000 average cost of a liver transplant.

Similarly, two separate reports on heart attacks found that using specialty drugs that would most likely prevent heart failure could lead to significant savings.

The first report from the National Bureau of Economic Research found that the average cost to traditional health insurers for the first 90 days following a heart attack is $38,501.

In the second study, the National Business Group on Health estimated that the average total cost of a severe heart attack is about $1 million over a patients’ lifetime. A patient suffering from a less severe heart attack accrues about $760,000 in healthcare costs.

Economists point out that a patient with cardiovascular disease or high cholesterol placed on $1,000-a-month PCSK9 inhibitors would need to live on the medication for more than 80 years before the cost of the drugs approached the cost of a severe heart attack.