Private labels play leading role for food and drug retailers

Private labels have evolved to be at the leading edge of innovation for many food and drug retailers, tapping into the latest consumer trends while retaining their “value” halo.

Sales of these products soared during the COVID-19 pandemic and have retained a dedicated following in many categories as consumers readily switched brands and sought more economical choices to stock their pantries and medicine cabinets.

“As proven in the past when consumers try own brands, the quality and value wins them over and many remain loyal consumers,” said Peggy Davies, president of the Private Label Manufacturers Association. “The past 10 years of growth of private brands, especially with discounters and mass merchandisers, are evidence of that.”

Target, Walmart, CVS, Kroger, Casey’s and many other retailers have all either expanded their own-brand lines or launched brand new private-label lines in plant-based products, pets or home goods, she said.

Drug store chains in particular have been aggressive in categories such as food, beverage, snacks and household goods in order to gain share from grocery and mass channels, Davies said. “By listening to their shoppers and positioning their offerings as a ‘one-stop shop’ in many departments, this strategy is delivering.”

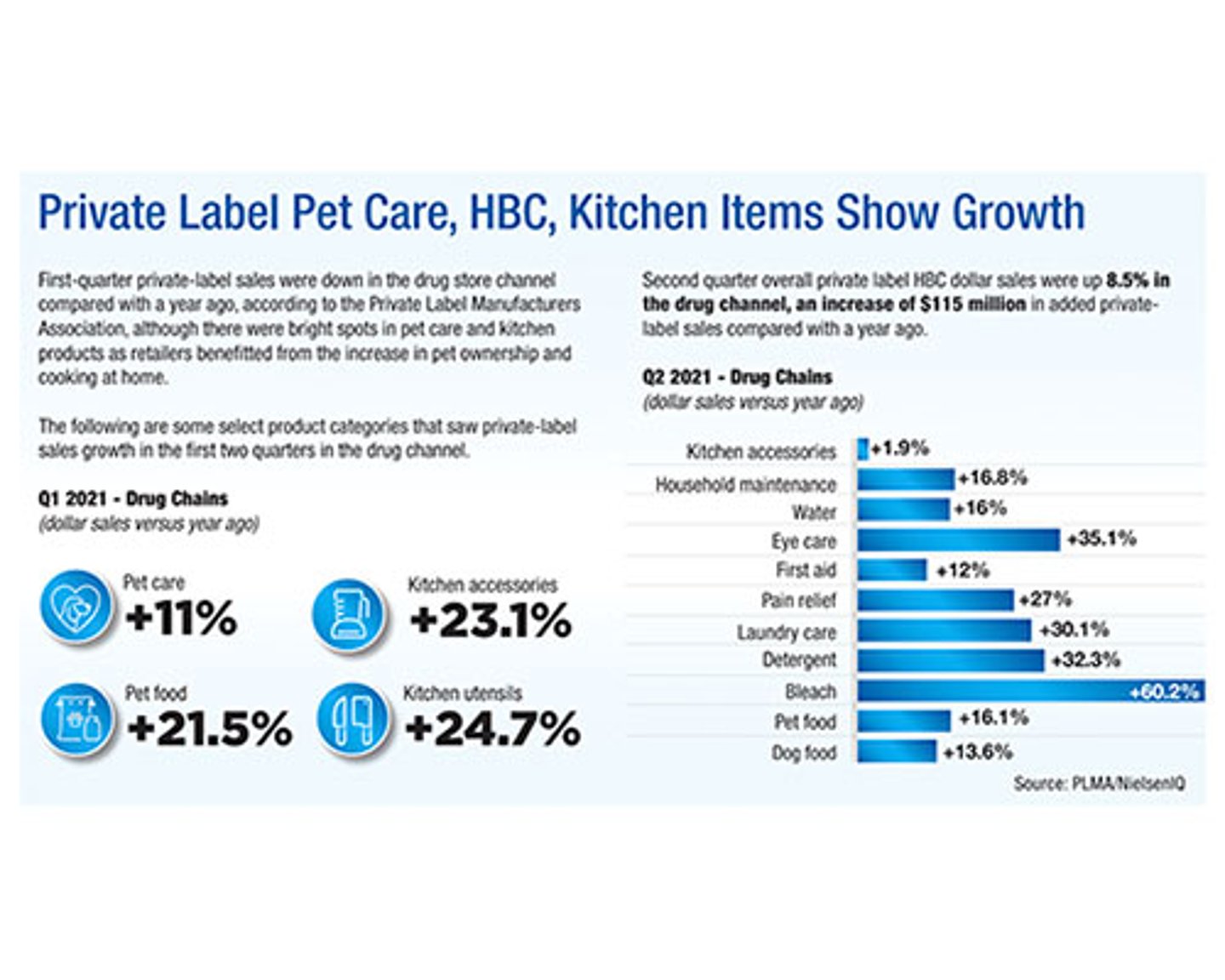

In the OTC and HBC categories, for example, store brands showed strong growth in the second quarter, year-over-year, compared with 2020, Davies pointed out, especially in pain relief, eye care and first aid products. In total, HBC private-brand dollar sales were up 8.5% in drug chains and had a 3.9% increase in unit share, she said, citing PLMA research from NielsenIQ.

[Read More: Better off safe than sorry: COVID-19 concerns, healthy food trends are driving immunity supplement sales]

She said drug stores may also have opportunities to expand their private-label assortments in edibles, citing CVS as an example of a company that has been a leader in this area with its store-brand food and beverage products, including snacks.

“Drug chains are the first place many turn to when they think of healthcare products, and while in the store or on the website, the purchase of snacks, beverages, etc., is a natural expansion of their purchase,” Davies said.

Retailers also have opportunities to drive private-label sales growth by offering discounts or incentives through their loyalty programs, she pointed out, citing both CVS and Walgreens as examples of drug store banners that promote their store brands effectively through their loyalty platforms.

Value-Based Solutions

Brenda Lord, vice president of private brands and quality assurance at CVS Health, agreed that consumer shopping habits shifted toward value opportunities during the pandemic. “With CVS store brands’ products averaging 20% to 40% lower in cost than competing brands, shoppers’ shift toward value directly impacted our sales of CVS Health and Live Better by CVS Health products, as customers were looking for more wellness products to be proactive about their health goals,” she said.

Lord noted that this year alone, CVS has added more than 400 new products under its portfolio of store brands, and the company has continued to see “an incredibly positive customer response” to these items. New products include vitamins and supplements, better-for-you snacks, and over-the-counter health products, she said, adding that offering these items in store-brand varieties “make some of the latest trends in wellness more accessible to the average consumer.”

In 2020, CVS’ overall store-brand portfolio grew six times faster than national brands, Lord said, and store-brand health-and-wellness offerings, including CVS Health and Live Better by CVS Health, grew at twice the rate of national brands, she said.

The company’s product introductions also included new items in the mental well-being category, including a Breathing Guidance Light to help guide users in calming exercises and a Daylight Lamp that seeks to create a healthier, natural work environment. CVS also expanded its at-home fitness and recovery assortment with resistance bands, massage tools and pain relief devices to empower consumers to relieve stress in a healthy way, Lord said.

[Read More: Over the moon for OTC: Several trends are converging and pushing sales up]

“The pandemic illuminated the importance of holistic health and normalized conversations on mental well-being,” she said. “As an enterprise, we are working to make mental well-being services more accessible, less complicated and more inviting.”

Consumer Trends in Private Label

Nicole Stump, director of CPG – category management at McKesson, said consumer shopping behavior evolved quickly during the pandemic, to the benefit of private label and retailers that have been able to provide depth and breadth in their product offerings.

“Consumers have demonstrated that they are willing — more than ever — to switch brands,” she said. “This has opened the door for private label to capture even more market share at a faster rate. It’s truly been remarkable.”

She agreed that consumers are taking a more proactive approach to their health, which has led to opportunities in categories such as vitamins, sleep remedies and homeopathic medicines.

“Often, we see brands lead in these areas with private labels acting as fast followers,” Stump said. “However, the market has shifted and private-label products are innovating faster than their competition.”

Amy Groth, marketing manager of private label at Garcoa Laboratories, a maker of personal care products, said consumers are seeking proven and safe lifestyle ingredients, such as turmeric, lavender, apple cider vinegar, tea tree oil and others in skin care, OTC, hair care, household cleaning and other categories.

One key trend is to bundle proven active ingredients with a natural oil or with homeopathic solutions, she said, which demonstrates that consumers are “looking for results, but also alternative remedies.”

Consumers also are seeking “no touch, no mess” packaging for ease of use or application as a benefit, Groth said.

Retailers also have been open to own-brand products that do not need a “compare to” claim to contrast with national-brand offerings, she said. “[This] shows strength in own-brand growth and ability to take market share from branded offerings.”

[Read More: Walmart launches private-brand analog insulin ReliOn NovoLog]

Michael Law, chief commercial officer at Eagle Labs, a contract manufacturer of a wide range of pharmaceutical and HBC products, said consumers are seeking

private-label products that can match or even exceed national brand quality. “Helping consumers save money has always been a key element, but the role of private label has shifted dramatically over time,” he said.

Retailers can build stronger connections with consumers by ensuring that their private labels are of high quality, Law said. “Private-label brands need to lead versus follow in key areas like sustainability, premiumization and building trials to gain share.”

To build share in private label, Law suggested that retailers on the leading edge of private-label branding and growth should consider these areas of opportunity:

• Focus on sustainability: Retailers should seek ways to increase their focus on environmentally friendly ingredients and packaging, including recyclable and reusable packaging, as well as the increased use of plant-based ingredients, he said.

• Increase efforts around premium/higher end private label: “Consumer trust in private labels has grown significantly over time and retailers that have built strong equity have permission to build premium private-label sub-brands that can increase margin and help them capture greater share,” Law said. “Consider leading with innovation instead of just waiting for the national brands to lead.”

• Lower consumer risk of trial: Retailers can help consumers switch to store brands by lowering the financial risk of trial, he said, citing tactics such as making it easy for customers to obtain refunds if they are not satisfied with a product, for example, or offering targeted, high-value coupons to encourage trial.

[Read More: Retailers use pricing, analytics to drive store traffic]

Looking Ahead

Supply chain delays and inflationary cost pressures for a range of consumer goods are expected to linger into next year, but industry leaders are optimistic about private label’s resilience.

Stump said McKesson has been working through the same supply constraints and logistics challenges that have been widespread across industries.

“We have been working proactively and collaboratively with our key supplier partners to ensure our demands align with their production plans, resulting in choices at shelf,” Stump said. “Sitting here 18 months ago, none of us could have predicted the uphill supply battle we have been facing since 2020. We are not out of the woods yet, but we are leveraging all available avenues together and we remain optimistic about where the retail landscape will be a year from now.”

PLMA’s Davies said the outlook is especially bright in health-and-wellness categories, as consumers continue to seek out products for preventative care. “As we move into 2022, a focus on health and wellness, sustainability in both products, and packaging, along with the development of plant proteins and organics for retailers’ own brands, will continue to drive share for retailers and profitable volume for both PLMA members and our retail partners,” she said.