In the coming years more retail pharmacy brands will adopt technology to gain a competitive edge

Retail pharmacies have gained a reputation for being slow to adopt new technology. But investments in technology and innovation will be a key differentiator for U.S. drug stores wishing to gain an edge over the competition, according to a November 2022 report from New York-based Coresight Research. That edge will be critical going forward, too, as the retail pharmacy landscape has changed dramatically in the past few years.

Those years have been “transformative,” taking the retail pharmacy sector beyond its traditional role of medicine dispenser, said David Pope, chief pharmacy officer for Dallas-based OmniSYS.

“Pharmacists and pharmacies are becoming the chosen source of urgent and primary care for patients,” he said. “The reasons beyond the shift vary, from consumer convenience to ease of healthcare access.”

Danny Sanchez, senior vice president and general manager for EnlivenHealth — the retail pharmacy solutions division of Santa Clara, Calif.-based Omnicell — noted that retail pharmacy also is facing significant challenges. Those range from declining reimbursements and inefficient pharmacy workflows to staffing shortages and antiquated billing systems.

“While COVID-19 intensified these pharmacy challenges, it also had the effect of accelerating major shifts in healthcare delivery, putting a greater focus on the highly accessible and trusted community pharmacy sector to deliver clinical services such as vaccinations and testing,” he said.

Progress noted

Retail pharmacy has made some progress in technology adoption. Pope said, for example, that billing-enabled electronic health records and other technology solutions have helped with the transformation of the last few years. Many retail pharmacies have recently invested in other technologies, too.

[Read more: 2022 DSN Industry Issues Summit panel weighs in on why shoppers need pharmacy more than ever]

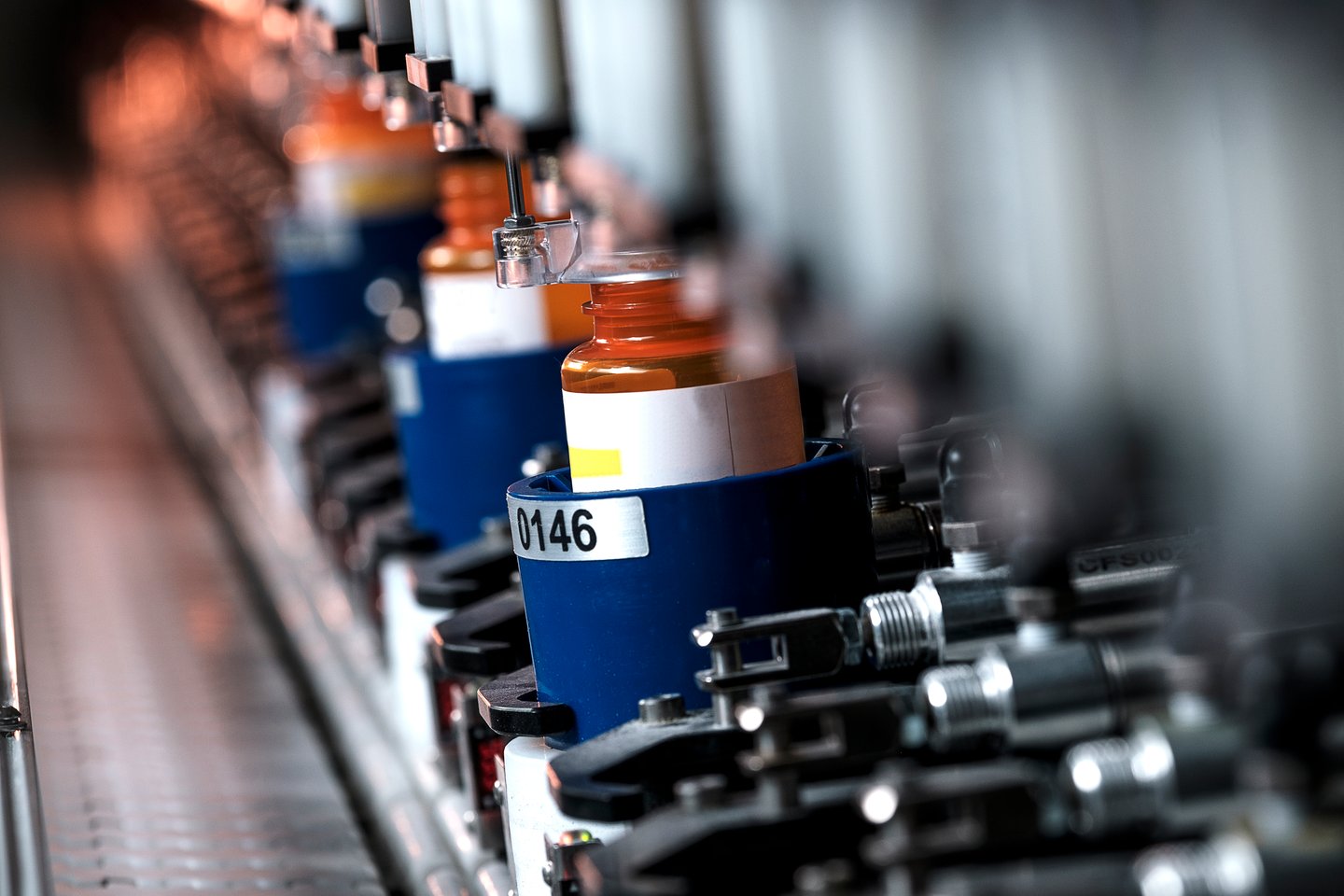

“I think technology has really earned its place in two spaces: central fill for pharmacy groups who have seen the efficiencies and benefits of ‘production’ centers, and in larger, high-volume retail pharmacies, where they have implemented pill-counting technologies,” said John Webster, vice president, innovation and product development for Crocus Medical, Saint Paul, Minn. “Independents have been slower to move toward automation, which is unfortunate because the key element to a successful independent pharmacy is strong relationships with the customers, but they are so busy ‘dispensing,’ they don’t have time to interact with their clients.”

Melanie Christie, vice president of product management for Columbus, Ohio-based CoverMyMeds, agreed that central fill technology has become more commonplace as consumers turn to retail drug stores for high-value, patient-focused care.

“Central fill technology, such as dispensing operations that are largely driven by robotics, is a lever they can pull to benefit from faster, cheaper and more accurate fills,” she said.

Using automation tools, pharmacists are able to save 45-plus minutes per 100 prescriptions filled over count-and-pour efforts, Christie noted, citing research published in the Journal of American Pharmacists Association. Central fill technology can allow more efficient direct-to-patient delivery, too.

Technology also came into play during the height of the COVID-19 pandemic. Many retail drug stores were able to make “on-the-fly” configurations to adjudication networks to accommodate billing complexities tied to vaccines, noted Kristina Crockett, vice president of project management for CoverMyMeds.

“Considering that 44% of all COVID-19 vaccines in the United States were administered at retail pharmacies, these edits allowed pharmacies to play a critical role on the front lines by helping to reduce the manual effort and time associated with processing a claim,” she said. “As a result, pharmacists have more time to provide patient care.”

[Read more: My small-town pharmacy’s big-time innovation]

Time To ‘Think Bigger’

It’s clear that retail pharmacies have made progress on the technology front. However, many challenges that could be addressed via technology remain.

Retail pharmacies must now think bigger, Pope said, if they are to truly deal with the transformation they’ve undergone in the past few years.

“The technological resources required for retail pharmacy to fully operationalize this transformation go far beyond most of what retail pharmacy operates today,” he noted. “Success looks like purpose-built pharmacy-first solutions, interoperability with disparate data sources, technology-facilitated new-provider relationships and, above all, in-pharmacist workflow.”

Technology and automation advances are already helping pharmacies and pharmacists offer more clinical services and better customer care, added Kevin Barton, vice president of product strategy, healthcare intelligence and analytics for Winston-Salem, N.C.-based Inmar.

“Leveraging new technologies and automation will further the progress the profession has made in displaying that pharmacies can do more to better the health and well-being of customers,” he said.

The tide does appear to be turning. Case in point: Philadelphia-based drug store chain Rite Aid and Google Cloud recently entered into a multi-year technology partnership. Under the partnership, Google Cloud technologies will provide Rite Aid with better insights, increased agility and improved customer experiences, the companies note.

Modernized applications for personalized digital experiences will enable pharmacists to spend more time directly engaging with customers. Rite Aid will be migrating key applications to Google Cloud's Anthos, a managed platform for application deployment, the companies said.

[Read more: PQS launches next-generation EQUIPP platform]

Embrace new technology

Outside of such partnerships, retail pharmacies could look to a number of new and emerging technologies to gain an edge over the competition.

Some of these technologies could help retail pharmacies manage two “big events” that will be coming their way during the next 15 months, noted Chris Smith, director of product strategy for Inmar. First to come will be full-scale implementation of the Drug Supply Chain Security Act (DSCSA), followed by the change of direct and indirect remuneration (DIR) to point of sale (POS).

“Supply chain solutions for both forward and reverse logistics are emerging as stakeholders across the channel have recognized the need to democratize the supply chain data to fulfill the requirements of the DSCSA,” he said. “The impact of the DIR shift to point of sale means that pharmacy teams and their finance and accounting partners need to be in sync. From forecasting the shift to POS to understanding the actual adjudication — plus any Effective Rate true-ups down the road — [it] will require the right data and communication.”

Speaking of data, more pharmacies are relying on it to improve inventory management and product flow through the pharmacy, Barton noted. But it can be challenging to identify inventory that needs to be returned. So there’s plenty of room to build on these efforts.

“Utilizing policy data and analytics, pharmacies can ensure they are optimizing revenue from returnable inventory by ensuring the returnable products fall within the guidelines of these different manufacturer policies,” he said. “Financials can be significantly improved by assessing a pharmacy’s current inventory and what needs to be returned. Applying inventory purchasing and dispensing data to return policy rule-engines and machine learning can ensure a pharmacy is getting as much credit for their returned product as possible.”

On the horizon for inventory management, meanwhile, are solutions that assist the process from the point of purchase through destruction, Barton noted.

“There is a significant opportunity to tie all of the data together to build algorithms that will reduce labor costs spent on inventory and allow this time to be allocated to focus more on the customer,” he said. “We should see these solutions become more widely available as they align with concepts that are shared by serialization and DSCSA requirements that are due to be implemented by November of 2023.”

Advances in central-fill operations also stand to benefit retail pharmacies. For example, retail pharmacies could take advantage of specialty-medication central-fill capabilities to broaden their patient offerings, Christie said.

“Today, such technology now includes the ability to dispense specialty medications, which typically come with a higher cost to dispense,” she explains. “Advancements to central-fill operations can also accommodate cold chain medicines.”

And technology now exists for retail pharmacies having difficulty dealing with the “disparate, disconnected technology platforms” needed for deploying patient engagement, financial and clinical management technologies, Sanchez noted. The new Enliven360 solution allows retail pharmacies to better engage patients, automate workflows, increase clinical services and enhance financial results. It’s fully integrated with the industry’s leading pharmacy management systems.

[Read more: Creating efficiencies for pharmacies, pharmacists in a post-COVID environment]

Another new EnlivenHealth technology, Personalized Interactive Voice Response, helps to address staffing shortages by decreasing administrative tasks and allowing pharmacists to focus on “patient-centric care,” Sanchez said. The cloud-based voice technology authenticates callers and then offers automated assistance. A community pharmacy in the Midwest slashed its phone transfer rates by almost 20% after adopting the new technology.

For its part, Surescripts introduced Clinical Direct Messaging to improve the communication between providers, said Lawrence King, director of product safety and performance for the Arlington, Va.-based company. The tool offers secure, EHR-integrated delivery of clinical communications and health information exchange, for improved care coordination and workflow efficiency.

And the Surescripts Network Alliance — technically not new, but always innovating — can help on the data management side, he noted. It currently links 2 million healthcare professionals and organizations across the United States.

“Practitioners are being hit from every direction with data, trying to organize and coordinate it all,” King said. “In an age of rampant burnout, SureScripts Network Alliance is working to improve interoperability — delivering the right information providers need at the right time to work with patients to make the right decision — ensuring the entire patient encounter is not spent clicking through different screens to find the insights needed.”

Speaking of data management, King noted that his company’s Real-Time Prescription Benefit and Specialty Medications Gateway now enable critical-information transfer to pharmacies. The prescription benefit helps pharmacies “solve for affordability and adherence upfront” via delivery of patient benefit information such as prior authorization flags and therapeutic alternatives. The gateway, meanwhile, simplifies the complex manual specialty enrollment process, slashing administrative burdens and streamlining provider-to-provider communications.

Consider automation advances

Automation advances outside of central-fill operations also spell opportunity for retail pharmacies. Automation is no longer limited to the pill-counting systems and the like, points out Brian Sullivan, principal – pharmacy solutions, North America for Knapp, Kennesaw, Ga.

“In recent years, we have seen more use of automated storage and retrieval systems like the KNAPP-Store,” he said. “If we can automatically induct, store and dispense medications [and] OTC and will-call orders in a very dense storage space, we can now reimagine the retail space, focusing on and expanding patient care. With DSCSA requirements fast approaching, the automated induction of medications reduces technician time, as these next-gen retail systems can automatically read individual serial numbers and accompanying data via 2D bar codes — meeting the latest DSCSA validation and tracking requirements.”

Yet another automation advance expands will-call “lockers” for off-hour pickup by patients, Sullivan noted. The KNAPP-Store 24/7 solution relies on a smartphone barcode reader to pull orders and nonprescription items on demand. The solution includes meth check, tele-pharmacy and payment capabilities.

Webster agrees that automated will-call/Rx self-retrieval lockers represent a major innovation — and believes they should have a wider role. They speed up fulfillment, eliminate line-ups and enhance convenience, so clients actually want to go to the retail pharmacy.

“Plus, and this is a key benefit, it frees up more time at the dispensary counter for counseling, focusing on the ‘health’ part of the customer interaction as opposed to the logistics/payment part,” he said.

New automation solutions can advance retail pharmacy efforts to help patients navigate affordability challenges, too, Crockett said. More than half of pharmacists — 54% — say they lack time to complete their job effectively, according to CoverMyMeds’ latest Medical Access Report.

“We’re beginning to see emerging technology that can help patients and pharmacists alike by automating the repetitive manual process of searching for and comparing various affordability options, including discount cards, to help patients find the best price,” she said. “Instead of pharmacists running and reversing a chain of claims using various discount cards to find the best option for patients, technology can do the heavy lifting and quickly present clear options to pharmacists and patients. As a result, more patients can leave the pharmacy with their medication at a price they can afford.”

Don’t wait to execute

Despite the potential benefits of new technology, implementation can be challenging. It requires a concerted effort on the part of the entire pharmacy team, noted Jason Ausili, head of pharmacy transformation for EnlivenHealth.“Getting the team’s buy-in early in the process will prepare pharmacists and technicians alike to be ready for the changes and get the most out of them,” he said.

And implementation worries should not be an excuse to put off new technology investments.

“Don’t wait to execute, and don’t wait to implement a tech stack that supports your efforts,” Pope said. “Payers are buying into pharmacists as providers, into retail pharmacy as the front door of health care. The time to get your technology platforms in place is now.”