Focus On: PharmaCare US builds demand for Sambucol brand

Patience is not only a virtue for officials at PharmaCare US, it is very much a huge part of their business strategy, designed to gain both consumer acceptance and get its products more and better placement at retail.

In fact, the 11-year-old company, a division of a privately held Sydney, Australia-based firm called PharmaCare, has built its business acumen by focusing on educating both consumers and retailers about Sambucol Black Elderberry, its flagship brand that has over the last few years become a darling of the vitamin/supplement category and the talk of the industry.

“Have sales exploded?” asked Art Rowe-Cerveny, the San Diego-based company’s vice president of marketing. “Well, let’s put it this way. In March of this year, we sold five times the number of products we sold in January of 2018. In fact, we sold more product in one month this year than we sold in an entire year just three years ago.”

PharmaCare certainly is a company with an interesting history, filled with stories of people who did not want to stray too far from the anointed course. When Toby Browne, the owner of PharmaCare in Australia and the company’s only shareholder, started the U.S. operation, he acquired Sambucol Black Elderberry, a struggling product with little consumer knowledge or interest in the domestic marketplace.

Today, according to Rowe-Cerveny, Sambucol Black Elderberry is one of the hottest products on the market that’s gaining steam as more shoppers realize its benefits to the immune system, especially as they look for any product to protect them and their families from the COVID-19 pandemic. And, PharmaCare, thanks to its due diligence, is the market leader in the category with an estimated 45% share, according to company officials.

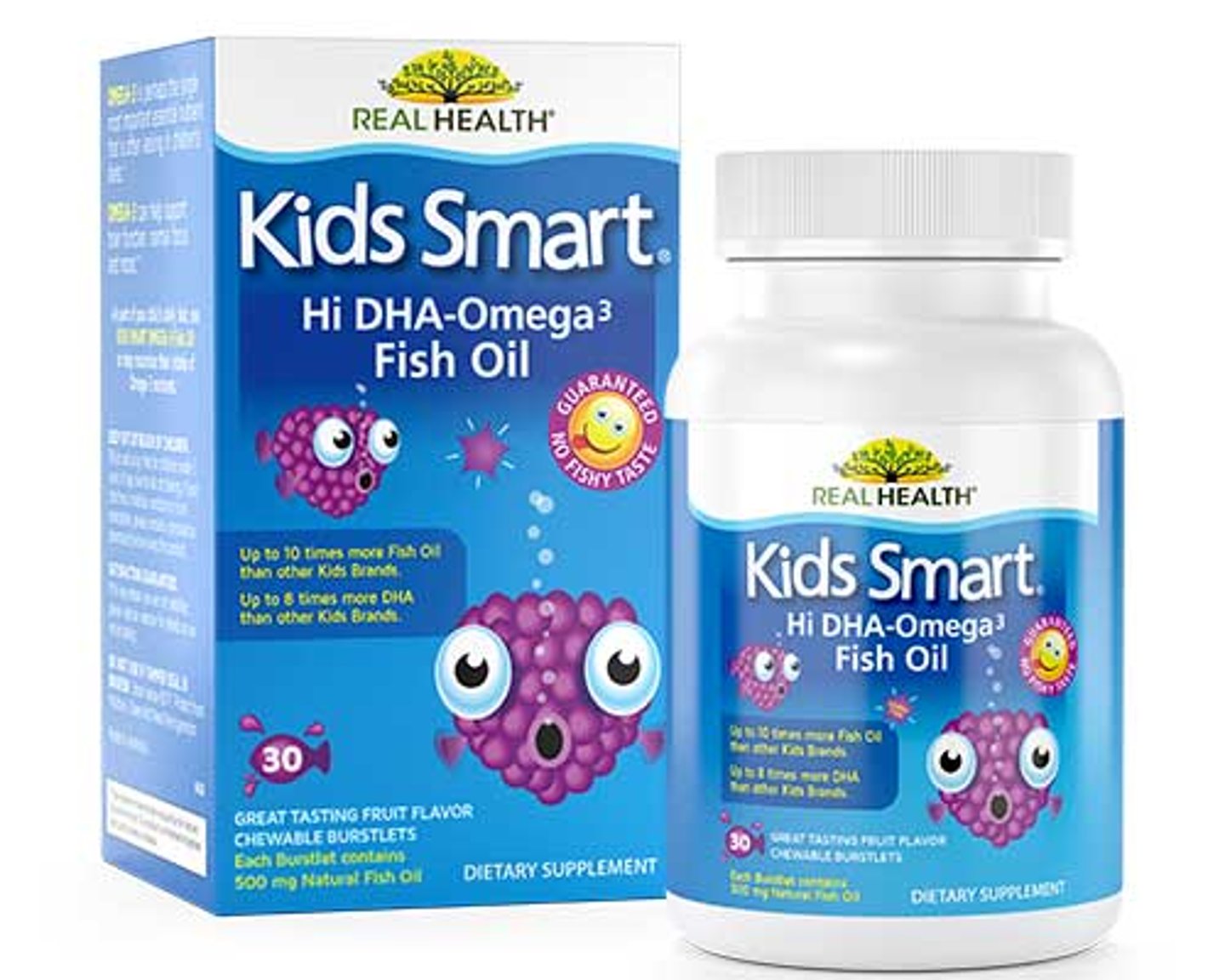

“The model in Australia was to find unloved brands, buy them, polish them up a bit and give them life again,” said Rowe-Cerveny, who has been with PharmaCare since its start in 2009. “Our owner had a lot of success with this model in Australia, and he wanted to branch out to the U.S. In a short amount of time, he acquired the rights to Sambucol Black Elderberry and Real Health Labs. Sambucol was down and out and Real Health was a nice, solid performer that gave us a nice entry into the domestic American market.”

That’s where having a lot of patience in what was basically a start-up brand started to play out. While other companies may have looked to hit a home run immediately, PharmaCare officials realized that they had a winner with Sambucol. At the same time, they also understood that they needed to educate consumers and merchants about the product’s attributes, specifically in the immune support realm.

“We knew from the start that our job was to get people to understand what black elderberry is and how it can help them,” Rowe-Cerveny said. “So, for about the first six or seven years that we owned the product, we focused on creating awareness of black elderberry and educating the consumer about the product. We really believed it was our responsibility and, frankly, we were the only company offering a black elderberry product to the mass-retail community.”

Social media also played a significant role in the brand’s growth. In 2018, while most viewed black elderberry as a micro-niche product, a housewife in Tennessee posted about Sambucol Black Elderberry and how it helped protect her family. “Within a week, it was shared 300,000 times and eventually was shared more than a million times on the site,” Rowe-Cerveny said. “One day, around that time, I got a phone call from a retailer who was already carrying the product and he just said to keep doing what we were doing. Product was flying off the shelves.”

Rowe-Cerveny said that PharmaCare officials found that their marketing approach that focused on building awareness of the product was working from reading Facebook comments. Sales, he said, rocketed up by 500% in just two weeks and might have increased more if PharmaCare did not run out of stock on product.

It also made company officials more aware that they could expand the reach of Sambucol Black Elderberry. While the cough-cold and flu season will always be an extremely important part of the product’s sales, Rowe-Cerveny said that company executives saw an opportunity to reach beyond that time of the year.

“We started a push to make people aware of the need for immune support year-round,” he said. “We did a large initiative around the back-to-school selling season to build sales with kids and their parents. The goal was to get the kids to like how our products, including gummies, tasted and their parents to like how we helped keep their children healthy.”

Using cable television, network radio, a print campaign, digital advertising and working with retailers on their own digital advertising also are helping to get the message out to consumers, Rowe-Cerveny said.

Today, PharmaCare offers about 20 SKUs of Sambucol Black Elderberry in syrups, tablets, gummies, pastilles, drinks and capsules. The company also makes some retailer-specific SKUs, while the Real Health line has three SKUs.

The future is about expanding the reach of the product. The vitamin/supplement and cough-cold sections will remain the backbone of company sales. Yet, Rowe-Cerveny said that retailers need to start placing Sambucol throughout the store to build awareness with consumers. He suggested that the pediatrics section, the pharmacy counter and even the checkout stand would be great locations to help sales. Eventually, new products containing black elderberry might be found in such categories as skin care and hair care, he said.

“We believe that the black elderberry market will eventually equal the size of the overall vitamin C category,” Rowe-Cerveny said. “This can be $500 million to $700 million, and it can be a category that brings more value and sales to retailers. We are extremely excited about the future of the category and our role in it.”