Sports drinks get a refresh

The sports drink aisle has been pretty stagnant for a while, but that’s starting to change.

Sports drinks are defined as functional beverages that help replenish glucose, fluids and electrolytes, according to the Harvard T.H. Chan School of Public Health. They are designed to help individuals hydrate and quickly replace the electrolytes lost in strenuous conditions or high-intensity workouts lasting an hour or more. For decades, sports drinks advertisements have depicted professional athletes at the gym or on the field.

[Read more: Sports nutrition category is poised for growth]

That advertising has helped the global electrolyte hydration drinks market become a $1.72 billion industry in 2023, according to Data Bridge Market Research. The market is expected to reach $3.26 billion by 2031, growing at a compound annual growth rate of 8.3% during that time.

But recently, consumers have decided they want something different from their sports drinks.

“I think America is starting to change the way that they look at sports drinks,” said Brandon Pogue, founder of TruLabs. “They have been marketed as a sports drink but, really, it’s just a sugary sweet good tasting drink that’s not good for you.”

[Read more: Body, heal thyself]

As a result, there’s been a groundswell of activity, from established companies to start-ups trying to fill the void. Here are three ways the sports drinks market is changing.

1. Mixed Drinks

In the past, sports drinks were focused on helping people power through their workouts. Now, sports drinks are seen as an element of a broader effort to maintain health and well-being.

“Customers can expect the sports drink aisle to look a whole lot different than it does today,” said Jesslyn Rollins, CEO of Biolyte. “Customers have demanded more functional sports drinks and that has brought a new category, rapid rehydration, front and center.”

Rapid rehydration products are lower in sugar and even higher in electrolytes. Similarly, companies are adding caffeine or other energy sources to their products to give consumers a boost. Companies are also adding collagen and protein to help people recover, build lean muscle mass and prevent sarcopenia (muscle loss).

“Consumers want function, real science and real results,” said Greg Clark, president of Nirvana Water Sciences, whose electrolyte line is infused with hydroxymethylbutyrate clear, a supplement designed to boost and protect lean muscle mass. “They don't simply want better-for-you drinks; they want truly healthy drinks that help them achieve their fitness, mobility or weight loss goals.”

That last point is especially important for people taking GLP-1 drugs such as Ozempic, Wegovy and Trulicity, which help people shed pounds—and muscle—quickly.

“Ozempic users are losing weight really fast, and they’re losing muscle first,” said Janice Day, chief sales officer of Promino Brands, maker of the forthcoming protein drink line Rejuvenate. “They’re not getting what they need from their protein sources to build or retain muscles.”

That’s where sports drinks can come into play; they can provide a supplemental source of protein that also tastes great.

2. Flavor and Science Forward

Traditionally, sports drinks were available in flavors reminiscent of children’s juice boxes. Now, companies are taking it up a notch.

For example, Biolyte’s tropical flavor tastes like a pina colada and its citrus flavor invokes margarita vibes. Nirvana Water Sciences offers flavors you might expect at a hotel lobby or spa: cucumber lime, orange peach and strawberry basil lemonade.

Pogue said TruLabs focuses R&D on performance—and on flavor. “We do all the science and all the research to make sure it’s healthy and going to do what it’s supposed to, but we also make sure it tastes really, really good.”

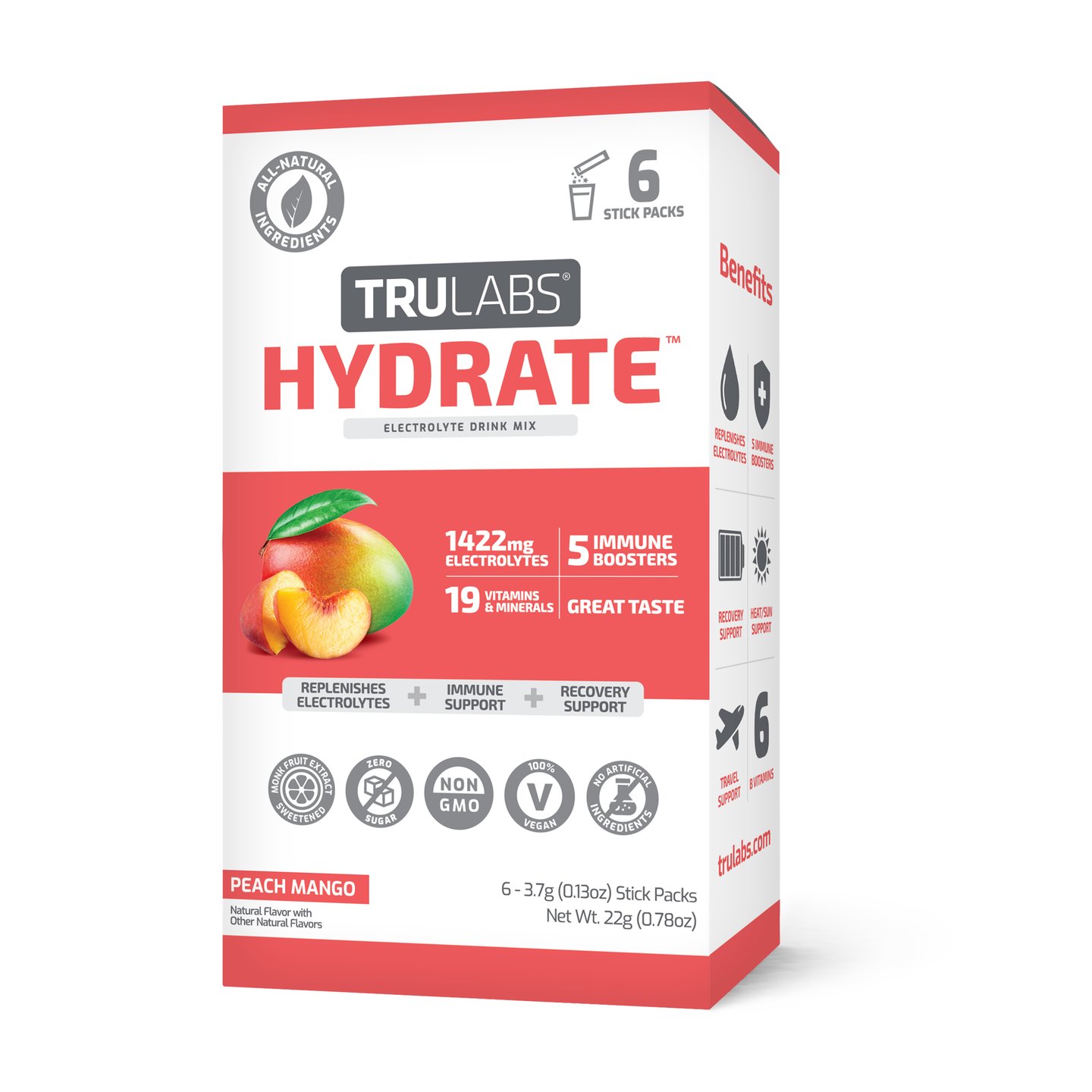

TruLabs doesn’t use sugar and has recently launched new flavors that are sweetened with monk fruit: peach mango, green apple and fruit punch, which includes a drinkable dihydromyricetin that can help people recover from the effects of alcohol, the company said.

An increasing number of sports drinks companies are also working with researchers, physicians and other experts to develop formulas that optimize performance, absorption and effectiveness. These are often clinical-grade products backed by scientific studies. Some are even patented.

For example, OP2 Labs, maker of Frog Fuel and ProT Gold, has developed the world’s only nano-hydrolyzed collagen protein, which is used in a clinical setting for about 14 medical indications. Still, OP2 Labs CEO and co-founder Alexander Kurz said that these products are about making sure consumers are getting everything their body needs from their diet and providing supplemental nutrients.

“We’re here to provide a full-body benefit, not just for athletes,” Kurz said.

3. Clean Ingredients

Customers are demanding sports drinks be made with quality ingredients. This means customers don’t want to see artificial dyes and flavors, hard-to-pronounce ingredients or a ton of sugar on the nutrition label.

“Consumers want to know they are getting a quality product with the macronutrient profile they need that, above all, tastes great,” said Stuart Heflin, senior vice president and general manager of Quest. “They don’t want to feel like they have to compromise anything. What they don’t want is a big calorie bomb laden with a lot of sugar.”

Customers also don’t want sports drinks to interfere with medications and chronic conditions, such as diabetes or irritable bowel syndrome. They do want sports drinks to accommodate any allergies, diets and other preferences they may have.

“I find that people in their late 20s, 30s and 40s are really starting to look at the label and nutritional content,” Day said. “They’re becoming way more conscious. They’re not just consuming drinks to consume drinks. They’re not as easily influenced when they see a product with an athlete holding it."

“Consumers want to invest in products that will actually do something for them health-wise, so they have the benefits that they need,” Day continued “They want the product to perform for them. They’re looking for something new and innovative that will make them feel good.”