Margins stay consistent for top toothpaste brands

Within the toothpaste category, Colgate Total and Crest 3D White were the two brands from their respective manufacturers that displayed the highest sales, and they both displayed higher units sold on promotion (28%). Sensodyne Pronamel was the top brand in toothpastes for GlaxoSmithKline, and it saw a much lower percent of promotion than other top brands (15%). For the last 52 weeks, sales were up compared with the previous 52 weeks for both Crest 3D White (23%) and Sensodyne Pronamel (15%), while sales were down for Colgate Total (-3%).

(To view the full Promo Watch report, click here.)

CPR’s trade spending analysis indicated that when deals were offered during the last year, Colgate offered the highest average total discount, showing on average 17% off list price for any off-invoice allowances or bill backs. However, the Colgate Total brand alone saw an average discount of only 12% for deals, perhaps contributing to the decrease in sales this year. GlaxoSmithKline (Sensodyne) offered an average of 16% total discount, while Church & Dwight (Arm & Hammer) offered an average of 13%, and P&G (Crest) offered just 9% off, on average.

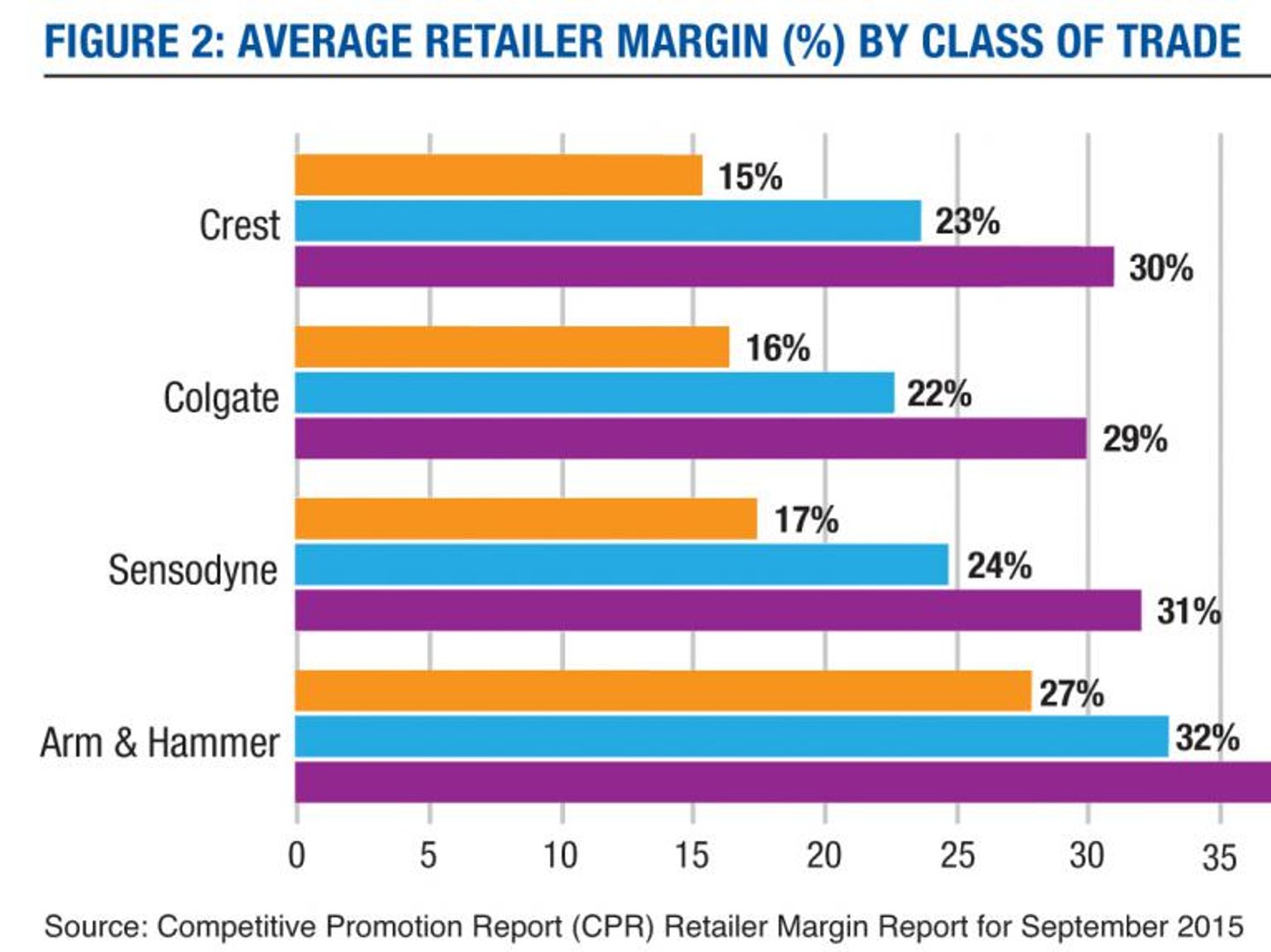

For the top toothpaste brands, margins were very consistent. The manufacturers of Crest, Colgate and Sensodyne controlled 89% of the market last year, and these brands reflected a spread of only 2% difference in average margin percentages within each of the mass, food and drug channels. Of these top brands, Sensodyne saw the highest margins in all three channels. Arm & Hammer was an outlier, showing margin percentages nearly 10 points higher, on average, than the other brands.

Colgate displayed the highest count of feature ads in the United States for the past three months (1,796). Sensodyne and Arm & Hammer both saw very little in the way of feature ads (178 and 212, respectively). The highest number of features were run at Kroger (362) followed by Kmart (118). Colgate’s feature ads showed the smallest percentage of price-only ads, with 45% compared with the other brands, which all saw a 50% or higher proportion of price-only ads.

DSN has partnered with Competitive Promotion Report and IRI to create a series of exclusive reports. This article highlights the market performance of major brands in the toothpaste category over the past 24 months ended Aug. 9. This analysis was gathered using CPR, IRI and ECRM data in terms of growth in retail sales, retailer margin percentages and retailer ads in the toothpastes category.

CPR is a leading provider of competitive market intelligence and insights in the health, beauty and wellness industry. Learn more by visiting competitivepromotion.com